A Guide to Registering a Private Company Limited in South Africa

The heart of entrepreneurship is the pulse of South Africa’s economy. Every day, individuals and teams dream of building businesses, creating jobs, and registering a private company leaving their mark on the world. But for that dream to become a reality, it needs a solid foundation. This foundation is the legal structure of your business, and for many ambitious South African entrepreneurs, that structure is a private company (Pty) Limited.

Why register as a private limited company?

For this reason, registering as a private company limited, also known as a “Pty Ltd,” is a popular choice. It offers a level of protection and structure that can benefit your business as it grows.

Here are some key advantages to choosing this route:

- Limited Liability: A PTY Ltd. separates your personal assets from the company’s assets. This means that your personal assets, such as your house or car, will remain generally protected in the event of financial difficulties or legal claims against your business.

- Tax Benefits: While tax laws can be complex, a PTY Ltd.’s structure often provides opportunities for tax planning and potential benefits.

- Credibility and Trust: Registering as a Private Company Limited communicates professionalism and dependability to clients, vendors, and investors.

- Raising Capital: PTY Ltd. makes it easier to raise capital from investors because it offers a more established and structured business model.

Here are the steps to register your PTY Ltd. in South Africa:

So, you’ve decided that PTY Ltd. is the right path for your business. Let’s now break down the steps involved in registering:

1. Select a memorable and available name:

This is the first and often most exciting step! Your company name is your brand identity, so choose something catchy, relevant to your business, and simple for people to remember. However, remember that:

- Uniqueness is key. The name you choose must be unique and not already registered with the Companies and Intellectual Property Commission (CIPC). On the CIPC’s website or through online tools like BizPortal, you can check for name availability.

- Think Long-Term: Avoid trendy names that might be outdated in a few years. Choose something timeless that resonates with your target market.

2. Create your Memorandum and Articles of Association (MoA and AoA).

These documents form the constitution of your company. They outline the fundamental rules, objectives, and regulations that will govern your PTY Ltd. The Memorandum of Agreement (MoA) and Articles of Association (AoA) provide crucial details concerning:

- Purpose: Your company’s goals and activities.

- The share capital structure encompasses the number of shares, their value, and shareholder rights.

- Directors and Management: The composition and responsibilities of your company’s board of directors.

You must carefully draft these crucial documents. You can consult with a legal professional or a company secretary to ensure they are compliant with South African law.

3. Gather the necessary documents and information.

Before you can submit your application to the CIPC, you’ll need to have the following documents and information ready:

- Identity Documents: Copies of all proposed directors’ and shareholders’ identification documents (ID or passport).

- Proof of Residential Address: Recent utility bills or other documents that verify the directors’ and shareholders’ residential addresses.

- Shareholding Details: The names and addresses of all shareholders, as well as the number of shares each will hold.

- Company Name Reservation: Confirmation from the CIPC that your chosen company name is available.

- Business Address: The physical location where you will register your business.

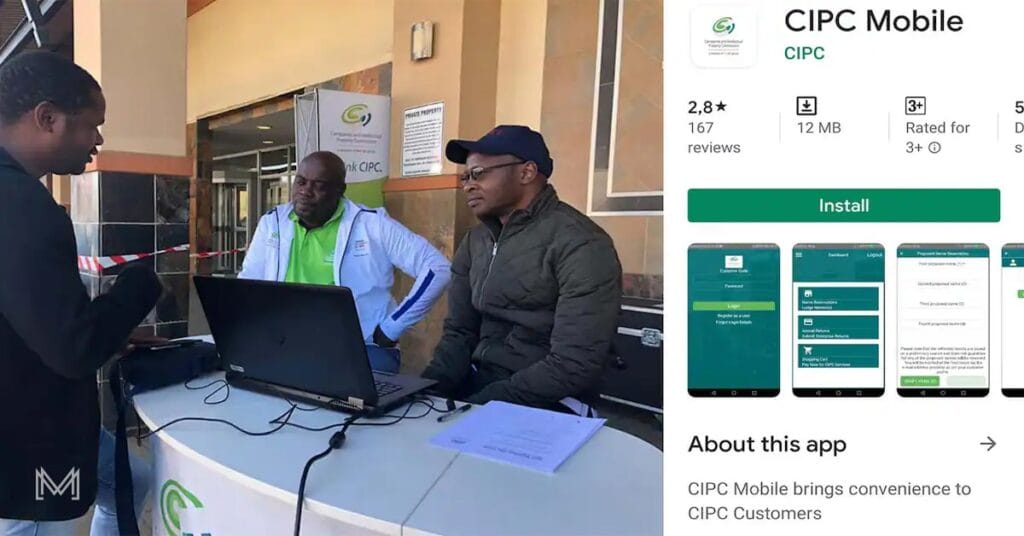

4. Please submit your application to the CIPC.

With all your documents in order, you can submit your application to the CIPC. You can do this:

- The CIPC has a website for registering companies online, which is the most convenient and efficient method.

- In person: You can visit a CIPC office to submit your application.

5. Pay the registration fee.

There is a fee associated with registering a PTY Ltd., which is payable to the CIPC. You can find the current fee on the CIPC website.

6. Receive Your Company Registration Certificate:

The CIPC will issue you a company registration certificate once they approve your application. This document serves as evidence of your PTY Ltd.’s legal registration and existence as a separate legal entity.

Step 7: Register for a Tax Number (VAT/SARS).

Once you’ve received your company registration certificate, you need to register with the South African Revenue Service (SARS) for a tax number. This is essential for managing your company’s tax obligations.

8. Create a business bank account:

Opening a dedicated business bank account is crucial. It helps separate your personal finances from your company’s finances, making it easier to track expenses and income.

9. Comply with legal requirements and regulations.

As a PTY Ltd., you’ll be subject to certain legal requirements and regulations. These include:

- Annual Returns: File annual returns with the CIPC about your company’s financial status and operations.

- Financial Statements: Preparing and auditing financial statements on an annual basis.

- Corporate Governance: Adhering to excellent corporate governance practices.

- Tax Obligations: Paying taxes as required by SARS.

Beyond Registration: Setting Up Your Business

After registering your company, you can begin concentrating on growing your business. This involves:

- Developing a Business Plan: A well-structured business plan outlines your company’s goals, strategies, and financial projections.

- Finding Your Target Market: Identifying your ideal customers and understanding their needs and preferences.

- Marketing and Branding: Creating a strong brand identity and promoting your business to attract customers.

- Building a Team: Hiring employees or partners who share your vision and contribute to your company’s success.

Popular Trends and Challenges:

The South African business landscape is dynamic, and entrepreneurs face both opportunities and challenges.

Some current trends:

- Digital Transformation: E-commerce and online businesses are booming, and digital marketing is becoming increasingly crucial for success.

- Sustainability: Businesses are focusing on environmental and social responsibility, making sustainable practices a key differentiator.

- Innovation: The focus is on developing innovative products and services to meet evolving customer needs.

Challenges:

- Economic Uncertainty: South Africa’s economy faces challenges, making it crucial to adapt and navigate volatility.

- Skills Shortage: Finding skilled and talented employees remains a challenge.

- Competition: The business environment is highly competitive, making it essential to stand out from the crowd.

Final Thoughts:

Registering a PTY Ltd. is a significant step on your entrepreneurial journey. It provides a robust legal framework for your business and allows you to pursue your goals with confidence.

Remember:

- Do your research. Familiarise yourself with the requirements and regulations.

- Seek professional advice: Don’t hesitate to consult with lawyers, accountants, or business advisors to ensure you’re making informed decisions.

- Stay informed: Keep track of changes in legislation and trends so that you can adapt your business strategy accordingly.

As you start this exciting venture, remember that entrepreneurship is about more than just legal structures. It’s about passion, perseverance, and a commitment to creating something truly valuable.

Frequently Asked Questions Concerning the Registering a Private Company Limited (Pty Ltd) in South Africa

What are the key advantages of registering a private company limited (Pty Ltd)? Registering a private company as a PTY Ltd. offers significant advantages for South African entrepreneurs. The most important is limited liability, which protects your personal assets from business debts. This means that if your company faces financial difficulties or legal issues, your personal belongings (like your house or car) are generally safe. Additionally, a PTY Ltd. can offer tax benefits, enhance credibility and trust with customers and investors, and make it easier to raise capital.

What documents are required to register a PTY Ltd.? Gather a few essential documents before submitting your application to the Companies and Intellectual Property Commission (CIPC). These documents include copies of all proposed directors and shareholders’ identity documents (ID or passport), proof of residential address for directors and shareholders, details of shareholding, confirmation of the CIPC’s company name reservation, and the business address where your company will register.

Can I complete my PTY Ltd. registration online? Yes, the CIPC offers a user-friendly online platform for registering a private company, making the process more convenient and efficient. You can submit your application, upload the necessary documents, and track the progress of your registration online. However, it’s still wise to consult with legal professionals for guidance during the process.

What are some current trends and challenges facing entrepreneurs in South Africa? South Africa’s business landscape is dynamic, with both opportunities and challenges. Current trends include digital transformation (e-commerce and online businesses are booming), sustainability (companies are increasingly prioritising environmental and social responsibility), and innovation (a focus on developing innovative products and services). Challenges include economic uncertainty, skills shortages, and intense competition.

How do I ensure PTY Ltd. is compliant with legal requirements after registration? You must fulfill ongoing obligations after registering your PTY Ltd., such as filing annual returns with the CIPC, preparing and auditing financial statements, fulfilling tax obligations, and adhering to good corporate governance practices. It’s crucial to stay informed about relevant legislation and regulations and to consult with professionals like lawyers and accountants to ensure compliance.

By taking the steps outlined above, you’ll be well on your way to turning your entrepreneurial dreams into a thriving reality in the dynamic and rewarding South African business landscape.

Disclaimer: This article serves as a general guide and does not represent legal advice. It is essential to consult with qualified professionals for legal and financial guidance specific to your situation.